Amid the myriad financial jargon and concepts, the Rule of 72 stands out for its simplicity and sheer utility. Even if Wall Street lingo seems foreign, understanding this Rule can be a game-changer. Given the previously provided content, here’s an enriched take on the Rule of 72, bolstered with additional insights to provide a comprehensive perspective.

Introduction to the Rule of 72

At its core, the Rule of 72 is a straightforward mathematical tool used in finance. It’s designed to give you a rough estimate of how many years it’ll take for an investment to double, given a fixed annual rate of return.

How the Rule of 72 Operates

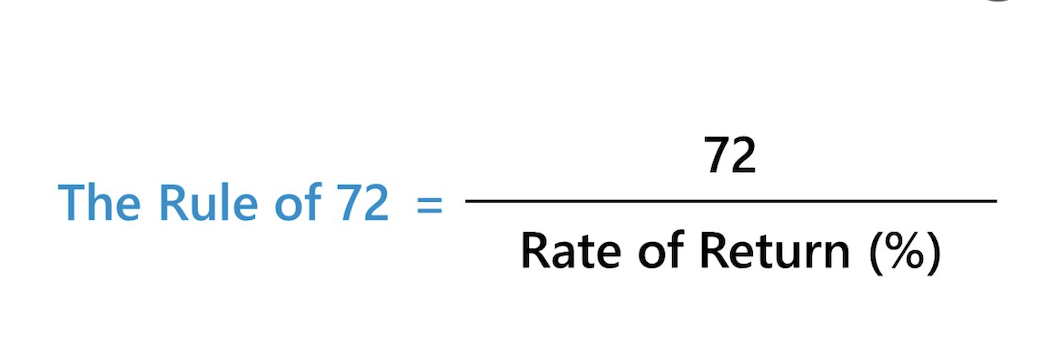

The principle is simple:

Years to Double = 72 / Annual Rate of Return

For instance, if an investment fund offers an annual interest of 6%, the Rule of 72 suggests:

72 / 6 = 12 years

This means it’ll take approximately 12 years for your money to double with a 6% return rate.

Comparing the Rule of 72 to Compound Interest Calculations

While the Rule of 72 offers a quick glimpse, a more exact method involves compound interest calculations. The formula is:

FV = PV (1 + r/m)^(mt)

Where:

- FV is Future Value

- PV is the Present Value

- r is the Annual Interest Rate (as a decimal)

- m is the Compounding Frequency (how many times interest is compounded annually)

- t is time in years

The result obtained from this formula might be slightly different from the Rule of 72. However, the latter still gets you in the ballpark without the nitty-gritty.

Practical Applications and Precision of the Rule of 72

Dave Ramsey mentions, “It’s a rough and dirty way to do investment math quickly in your head. It could be better, but it does work.

The Rule of 72 is not an exact science, but it’s close, especially for quick calculations. For precise projections, especially for larger investments or longer time horizons, resorting to detailed compound interest calculations might be more suitable.

Additional Factors Impacting Investment Growth

While the Rule of 72 is insightful, it’s also essential to account for other factors that can influence investments:

- Inflation: This reduces the purchasing power of money over time. An investment’s real return is its nominal return minus the inflation rate.

- Taxes: Capital gains and dividends might be subject to taxation, affecting net returns.

- Investment Fees can eat into your returns, especially over longer periods.

- Market Volatility: Real-world investments don’t always yield a constant return year after year. Economic cycles, geopolitical events, and other factors can introduce volatility.

Final Thoughts

The Rule of 72 is a fantastic tool for quick, back-of-the-envelope calculations about your investments. It’s perfect for casual discussions or rough planning. However, relying on detailed calculations and seeking expert advice is crucial when diving deep into investment strategies.

For those less inclined to tackle compound interest calculations, financial experts equipped with sophisticated tools can help. Services like SmartVestor Pro connect individuals with qualified professionals, ensuring sound investment advice.

Remember, investing is about understanding formulas and the bigger financial landscape. Stay informed, seek expert insights when needed, and make your money work for you.